Vietnam Ranks Second After China in Software Outsourcing for Japan

— July 18, 2016For years, India and China dominated Japan’s software outsourcing market, serving as top providers for IT services. However, recent data from the Global Outsourcing Market research indicates a notable shift: Vietnam has overtaken China to claim the second position in Japan’s software outsourcing landscape, a move hailed by industry insiders as significant for Vietnam’s burgeoning IT sector.

Market Shift: India, Vietnam, and China in Japan’s Outsourcing Ecosystem

India retains its position as Japan’s largest outsourcing partner, commanding 31.5% of the market share, followed closely by Vietnam at 20.6%, which pushed China to third place. This advancement highlights a major achievement for Vietnam’s tech sector, positioning the country as a strong competitor in a market previously dominated by two giants.

Why Japan is Turning to Vietnam

Several factors have fueled Vietnam’s rise in Japan’s software outsourcing market. Cost is a critical driver: according to Nikkei, hiring Vietnamese IT engineers is about 30-40% less expensive than hiring their Chinese counterparts, making Vietnam an attractive alternative for Japanese companies seeking cost-effective solutions without compromising on quality.

Moreover, Vietnamese firms are solidifying their presence in Japan, as evidenced by companies like FPT, VietSoftware International, and TMA Solutions. Japan ranks among their top markets, and this focus reflects the importance of the Japanese IT sector for Vietnam’s outsourcing industry.

Rising Demand for IT Talent in Japan

Japan’s government, driven by ambitions to become a global leader in IT innovation, is pushing initiatives to integrate advanced technology across industries. According to Shigeki Maeda, Vice President of JETRO Tokyo, Japan is committed to building the world’s most advanced IT-enabled society. Yet, the demand for IT talent in Japan has skyrocketed, far outpacing the domestic supply. This shortage of skilled workers has led Japanese companies to look abroad, opening up significant opportunities for outsourcing partners like Vietnam.

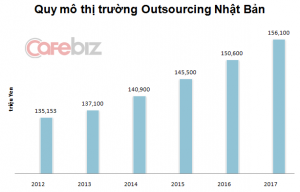

The scale of Japan’s IT outsourcing market is growing in response to this demand. Between 2012 and 2015, the market expanded from 135 billion yen to 145.5 billion yen ($1.4 billion USD). By 2017, it is projected to reach 156 billion yen. Unlike firms in the US and Europe, where only about 10% of contracts focus on outsourcing, Japanese companies outsource a significantly larger share of their software development needs, creating a steady demand for reliable Vietnam software outsourcing partners.

Vietnam’s Workforce: Strengths and Challenges

Japanese companies recognize the strengths of Vietnam software development, noting qualities such as intelligence, dedication, and adaptability. Katsuro Nagai from the Japanese Embassy in Vietnam praised Vietnamese engineers as being hardworking and quick learners, yet he acknowledged an existing gap between supply and demand for highly skilled workers, especially those proficient in complex programming languages and niche technologies.

Vietnam’s rise to second place, however, has sparked debate within the industry. While many see outsourcing as an engine of growth, others argue that Vietnam’s IT sector should aspire to develop proprietary software products, rather than merely providing services to foreign clients.

Debate: Outsourcing vs. Product Innovation

Some industry experts believe that for Vietnam to truly distinguish itself on the global tech stage, it should focus on creating “Made-in-Vietnam” software products rather than outsourcing for international clients. However, others contend that Vietnam’s strengths lie in service-based offerings.

Hoang Nam Tien, President of FPT Software, openly supports Vietnam’s current focus on outsourcing. “We at FPT Software understand ourselves as an outsourcing company, and we’re comfortable with that identity,” Tien remarked. He sees the global software industry as comprising two branches—software products and services. Vietnam, according to Tien, is well-suited to excel in the services sector, an area with consistent demand and growth potential.

“In reality, only a few companies globally dominate the software products sector,” Tien explained, citing IBM’s emphasis on services rather than product creation. “We at FPT discussed whether to focus on products or services, and we concluded that service is the way forward for us.” This pragmatic approach has allowed FPT and similar firms to capitalize on Japan’s outsourcing needs while positioning themselves as reliable, service-oriented partners.

The Future of Vietnam’s IT Outsourcing in Japan

As Japan’s appetite for IT solutions continues to grow, the demand for qualified outsourcing partners will likely increase. Vietnam, with its skilled labor pool, cost advantages, and proximity to Japan, appears well-positioned to meet this demand. Furthermore, Vietnamese firms have demonstrated adaptability, cultural understanding, and the ability to align with Japanese work ethics—qualities highly valued in Japan’s business environment.

The question remains whether Vietnam’s IT sector will eventually pivot toward more product-based development or continue to deepen its focus on outsourcing. However, for now, Vietnam’s emphasis on service delivery aligns well with Japan’s needs, providing a stable foundation for growth.

With strategic investments and a focus on talent development, Vietnam’s IT outsourcing industry could see even greater achievements. The evolving relationship between Japan and Vietnam signals a new chapter for both nations, one that not only strengthens their economic ties but also paves the way for collaborative innovation in the technology sector.